2023/2024 Tax Rates For All Nova Scotia Municipalities

The various agencies of Nova Scotia do a commendable job of publishing information online for residents to access. The problem is, it’s often not presented well. We’ve waded through obscure apps, bizarre data viewers, and cumbersome data tables to find and surface what most people are looking for in a simple format.

To that end, here’s your tax rate bud.

Source: data. novascotia.ca (as of Oct. 21, 2024)

We’ve also compiled a full list of Nova Scotia municipal land use bylaws and zoning maps. Also, if tax rates are on your mind, you may be interested in our take on Nova Scotia property assessments. And of course, be sure to check out our comprehensive Buyer’s Guide: How to Buy Land in Nova Scotia. Lastly, if you want to understand all of the type of taxes a Nova Scotia land owner can be subject to, read our post on Taxes on Land Sales in Nova Scotia.

| Area | Area Type | Residential Tax Rate |

Commercial Tax Rate

|

| Cape Breton Tax Rates | |||

| Cape Breton MUN – Suburban | Cape Breton Regional | 1.87 | 4.61636 |

| CITY OF SYDNEY | Cape Breton Regional | 2.2154 | 5.556 |

| DOMINION | Cape Breton Regional | 2.0154 | 5.084 |

| GLACE BAY | Cape Breton Regional | 2.0418 | 5.11 |

| LOUISBOURG | Cape Breton Regional | 2.0713 | 5.14 |

| NEW WATERFORD | Cape Breton Regional | 2.0286 | 5.097 |

| NORTH SYDNEY | Cape Breton Regional | 2.054 | 5.422 |

| SYDNEY MINES | Cape Breton Regional | 1.939 | 5.007 |

| Halifax Region Tax Rates | |||

| BEDFORD | Halifax Regional | 1.115 | 3.553 |

| COUNTY RURAL | Halifax Regional | 0.968 | 3.108 |

| COUNTY SUBURBAN | Halifax Regional | 0.979 | 3.553 |

| COUNTY URBAN | Halifax Regional | 1.115 | 3.553 |

| DARTMOUTH | Halifax Regional | 1.115 | 3.533 |

| HALIFAX | Halifax Regional | 1.115 |

3.533 |

| HALIFAX URBAN CORE | Halifax Regional | 1.21 |

3.29 |

| Queens Region Municipal Tax Rates | |||

| LIVERPOOL | Region of Queens | 1.93 | 3 |

| QUEENS COUNTY | Region of Queens | 1.04 | 2.14 |

| West Hants Municipal Tax Rates | |||

| WEST HANTS | West Hants Regional Municipality | 0.5314 | 0.98 |

| WINDSOR | West Hants Regional Municipality | 0.5314 | 0.98 |

| HANTSPORT | West Hants Regional Municipality | 0.5314 | 0.98 |

| All Other Nova Scotia Municipal Tax Rates | |||

| ANNAPOLIS | Rural Municipality | 1.025 | 1.8 |

| ANTIGONISH | Rural Municipality | 0.88 | 1.44 |

| ARGYLE | Rural Municipality | 1.11 | 2.29 |

| BARRINGTON | Rural Municipality | 1.07 | 2.56 |

| CHESTER | Rural Municipality | 0.695 | 1.5 |

| CLARE | Rural Municipality | 1.04 | 2.07 |

| COLCHESTER | Rural Municipality | 0.885 | 2.28 |

| CUMBERLAND | Rural Municipality | 1.14 | 2.71 |

| DIGBY | Rural Municipality | 1.3 | 1.85 |

| EAST HANTS | Rural Municipality | 0.81 | 2.57 |

| GUYSBOROUGH | Rural Municipality | 0.77 | 2.74 |

| INVERNESS | Rural Municipality | 1.05 | 1.91 |

| KINGS | Rural Municipality | 0.853 | 2.287 |

| LUNENBURG | Rural Municipality | 0.81 | 1.957 |

| PICTOU | Rural Municipality | 0.815 | 1.825 |

| RICHMOND | Rural Municipality | 0.85 | 2.15 |

| SHELBURNE | Rural Municipality | 1.28 | 1.85 |

| ST. MARY’S | Rural Municipality | 0.97 | 2.28 |

| VICTORIA | Rural Municipality | 1.22 | 2.12 |

| WEST HANTS | Rural Municipality | 1.0323 | 1.8 |

| YARMOUTH | Rural Municipality | 1.18 | 2.17 |

| Tax Rates for Nova Scotia Towns | |||

| AMHERST | Town | 1.67 | 4.47 |

| ANNAPOLIS ROYAL | Town | 1.7 | 3.2 |

| ANTIGONISH | Town | 1.11 | 2.63 |

| BERWICK | Town | 1.578 | 3.89 |

| BRIDGEWATER | Town | 1.85 | 4.07 |

| CLARK’S HARBOUR | Town | 1.68 | 5.58 |

| DIGBY | Town | 1.91 | 4.2 |

| KENTVILLE | Town | 1.4262 | 3.2962 |

| LOCKEPORT | Town | 2.4 | 5.41 |

| LUNENBURG | Town | 1.376 | 3.358 |

| MAHONE BAY | Town | 1.324 | 3.264 |

| NEW GLASGOW | Town | 1.84 | 4.45 |

| MIDDLETON | Town | 1.81 | 4.29 |

| MULGRAVE | Town | 1.2375 | 4.5257 |

| OXFORD | Town | 1.7874 | 4.2804 |

| PICTOU | Town | 1.69 | 4.34 |

| PORT HAWKESBURY | Town | 1.58 | 4.16 |

| SHELBURNE | Town | 2.01 | 3.88 |

| STELLARTON | Town | 1.88 | 4.3 |

| STEWIACKE | Town | 1.58 | 3.45 |

| TRENTON | Town | 2.04 | 4.1 |

| TRURO | Town | 1.9025 | 4.5475 |

| WESTVILLE | Town | 2.13 | 3.95 |

| WOLFVILLE | Town | 1.4575 | 3.575 |

| YARMOUTH | Town | 1.69 | 4.31 |

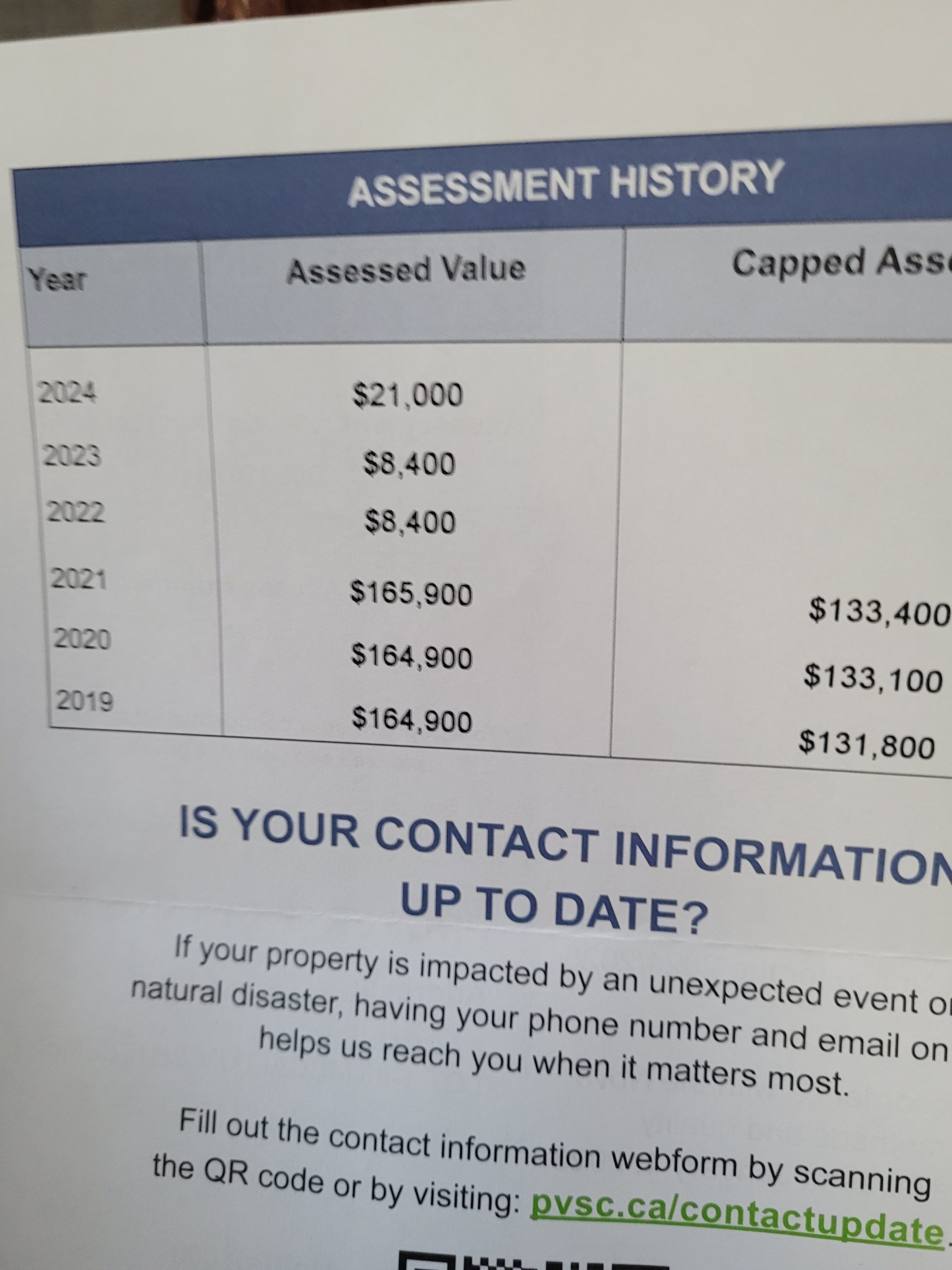

That’s the most important number! That reflects the property value that will determine your Nova Scotia property tax. Unless you have a capped assessment, in which case you’ll pay tax on the lower of the two numbers.

That’s the most important number! That reflects the property value that will determine your Nova Scotia property tax. Unless you have a capped assessment, in which case you’ll pay tax on the lower of the two numbers.