In the early months of each year, all Nova Scotia property owners will receive a mailing from Nova Scotia’s Property Valuation Services Corporation. This is your property assessment notice, and it directly influences the Nova Scotia property tax you will pay in the coming year. Let’s break it down.

How do I ensure my property details are accurate?

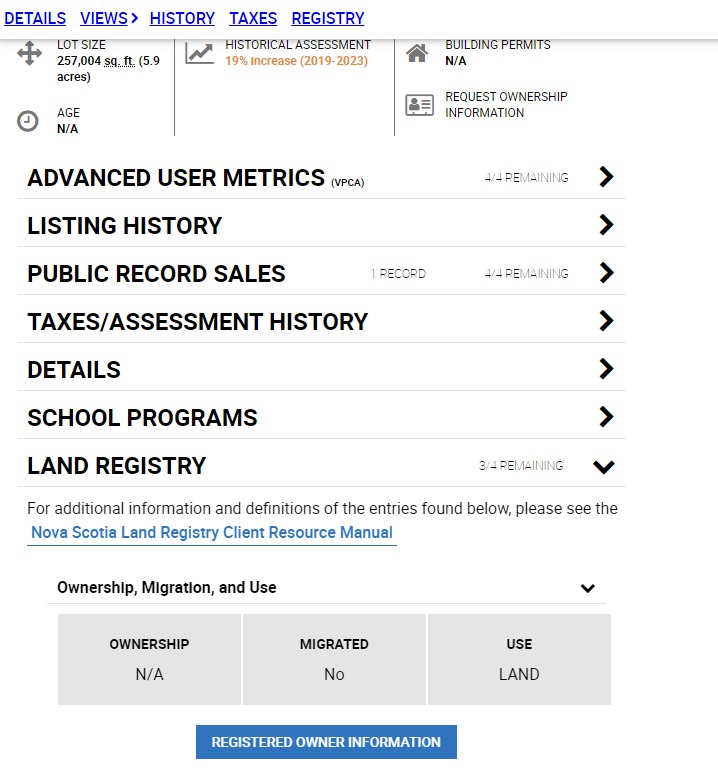

At the top right, you’ll see the Assessment Account Number (AAN) for your property. You can use this 8-digit number to view your property details online. This will show property boundaries, any buildings on the land, and prior assessment values. You won’t find much variation from year to year, but it’s important to make sure you’re being assessed for the property you actually own.

What is the timeframe for the property assessment?

Your assessment reflects your property’s market value as of the first date of the year (e.g. January 1, 2023) and its physical state as of a date late in the year (December 1, 2023 for this year). The gap in between these dates matters. If, for example, you tore down an old house and build a huge mansion during that time period, you may receive an assessment that is much higher than the value of that old house due to the changes you’ve made on the property.

How does the PVSC know the state of my property?

They have an assessor hiding in the bushes watching your property at all times. Just kidding 🙂 Some properties receive a physical visit, resulting in a photograph of your property. You can see these by looking up your property details online using the AANN number. Many properties are simply updated using a set of valuation rules.

Do I have to make a payment?

The property assessment is not a bill, but it will affect one important bill that you receive: your Nova Scotia property tax bill. If your assessment value goes up, you’ll be paying more taxes in the year ahead.

What is the property assessment classification?

Your property will show a “classification” such as RESIDENTIAL TAXABLE, or RESOURCE TAXABLE. If your property has more than one use, you might see multiple classifications. Most properties will fall under these categories:

- Residential property: single-family residences, multi-family residences, duplexes, apartments and condos, nursing homes, seasonal dwellings, manufactured homes, and vacant residential land.

- Resource property: Farm property, forest property totaling less than 50,000 acres

- Commercial property: Property deemed for commercial use, and forest property over 50,000 acres

The determination of residential vs. commercial properties is governed by your local municipal bylaws and zoning maps.

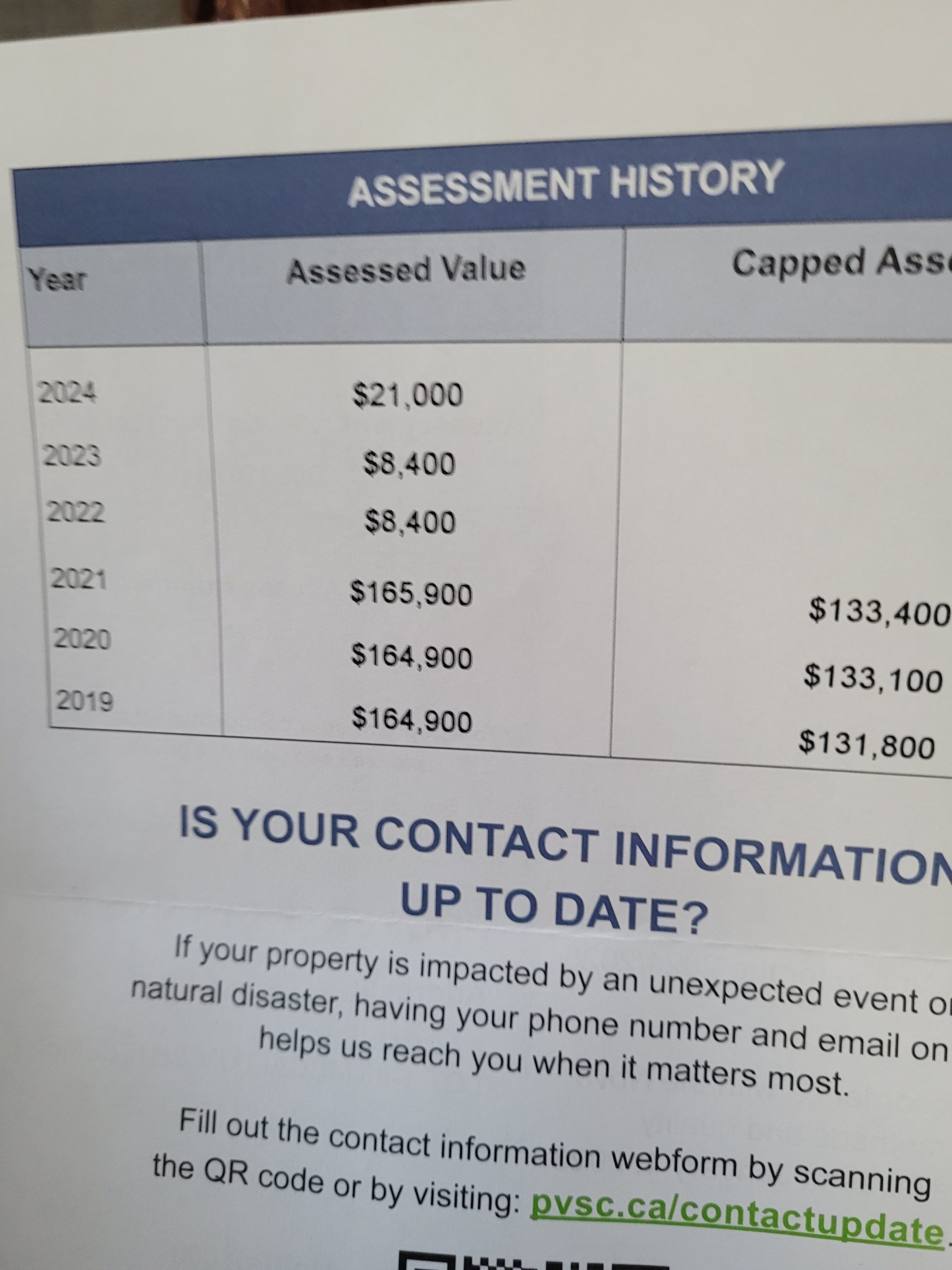

What is a Capped Assessment, and how does it affect Nova Scotia property tax?

A capped assessment places a limit that the taxable assessment for a residential property can increase from year to year. The property must be:

- at least 50% owned by a Nova Scotia resident (another drawback for foreign owners). If your residency has changed – say you moved to Nova Scotia and now qualify as a resident, you can notify PVSC using the CAP Notice of Residency form.

- a residential property with less than four dwelling units or vacant resource property

- If it’s a condominium, it must be owner-occupied

- To qualify for the cap the property must be owned for at least a year, or ownership remained within the family.

When a property is sold, the cap will be removed in the following year unless it is sold to a family member.

The 2024 Cap rate is 3.2%.

What is the Taxable Assessed Value?

That’s the most important number! That reflects the property value that will determine your Nova Scotia property tax. Unless you have a capped assessment, in which case you’ll pay tax on the lower of the two numbers.

That’s the most important number! That reflects the property value that will determine your Nova Scotia property tax. Unless you have a capped assessment, in which case you’ll pay tax on the lower of the two numbers.

How much Nova Scotia Property Tax will I pay?

That depends on your municipality. They determine their budgets and set tax rates that will cover the costs for municipal services (and possibly some fancy ergonomic keyboards because they’re tired of typing on a cheap old clacker). We created a really long table with all of the municipal tax rates in Nova Scotia for the 2022/2023 year.

What should I look for in my property assessment history?

You want to check how the assessment value has changed, and how that will impact the Nova Scotia property tax you pay. If it has jumped up substantially, you have an option to appeal.

How do I appeal my Nova Scotia property assessment?

The property assessment you receive has a small form on the back. You can fill it out and mail, email or fax it to PVSC. You MUST do this by the deadline. The current deadline is midnight, February 8, 2024.

- To submit by mail: mail the completed form to Assessment Appeals, 6-15 Arlington Place, Truro, Nova Scotia, B2N 0G9

- To submit by email: send a scan or a photo of your form to inquiry@pvsc.ca

- To send by fax: 1-888-339-4555 (within North America) or 1-902-893-6101 (outside North America)

How does the appeal process work?

I have successfully appealed one property, so I’ll use that example here. I submitted the form and within a few weeks I received a call to discuss the details. I guess my claim was considered legit, because it was then passed on to an assessor, who called me about a month later.

Everything sounded positive. I had a pretty strong case because the property in question had a house on it that was falling apart and non-habitable, but the assessment value was still based on the market value of the home when it was in suitable condition. So, some months went by and I received the paperwork for my new assessment, which was reduced by over $100,000.

There is no cost to appeal, and you do not need a lawyer. Though of course, if you get into some gnarly property issues a Nova Scotia property lawyer may be useful.

Want more on tax?

If you want to learn more about the full range of taxes a Nova Scotia land owner may be subject to, read our post on Taxes on Land Sales in Nova Scotia.